Filing taxes is one of the most important responsibilities for small business owners. Regardless of industry or size, every business must report its earnings and meet federal and state tax obligations. Knowing how to file small business taxes not only ensures compliance but also helps businesses reduce liabilities through legal deductions and avoid costly penalties. This post offers a comprehensive, step-by-step guide for small business owners to understand and execute the tax filing process with confidence.

Step 1: Gather Business Financial Records

The first and most critical step in filing small business taxes is organizing all financial records for the tax year. Accurate documentation ensures that reported income and expenses reflect the true performance of the business and serve as evidence in case of an audit.

Small businesses should collect and organize:

- Income statements: Sales receipts, online transaction reports, invoices, and deposit records.

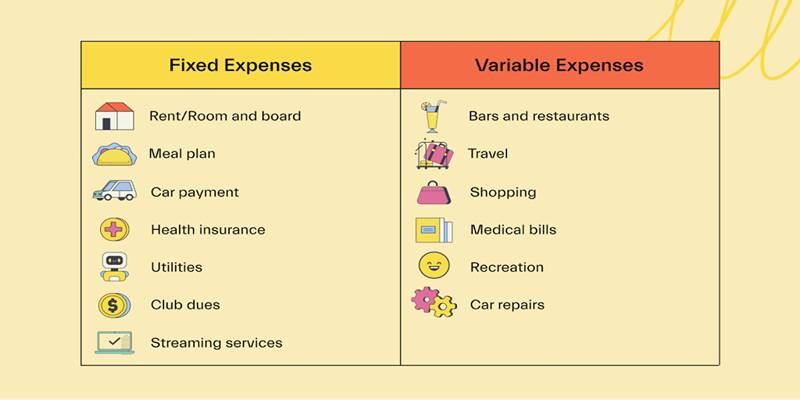

- Expense records: Utility bills, rent, equipment purchases, travel costs, and marketing expenses.

- Bank statements: From both business and relevant personal accounts, if applicable.

- Payroll and employee records: Including Form W-2, W-3, Form 941, and state filings.

- Contractor payments: Form 1099-NEC for contractors paid over $600 annually.

- Asset and depreciation schedules: For any business equipment or property acquired.

- Mileage logs: If business vehicles were used.

Using accounting software or working with a bookkeeper simplifies record management and minimizes errors. Organized records allow for faster form completion and improved deduction accuracy.

Step 2: Determine the Correct IRS Forms

The structure of a small business determines which tax forms need to be filed. The Internal Revenue Service (IRS) provides different forms depending on whether a business is a sole proprietorship, partnership, LLC, S corporation, or C corporation.

Key forms based on the business entity:

- Sole Proprietorship and Single-Member LLC: Use Schedule C (Profit or Loss from Business) attached to the owner's Form 1040. The owner also submits Schedule SE to report and pay self-employment taxes.

- Partnerships and Multi-Member LLCs: File Form 1065 and issue Schedule K-1 to each partner to report their share of the business’s profits or losses on their return.

- S Corporations: Must file Form 1120-S. Shareholders receive Schedule K-1 to report income and deductions individually.

- C Corporations: Submit Form 1120 to report the corporation’s income and tax liability separately from the owner’s taxes.

- Employment Taxes: All businesses with employees must file Form 941 quarterly and Form 940 annually to report payroll tax obligations.

- 1099 Filings: Businesses paying freelancers or independent contractors $600 or more must file Form 1099-NEC with the IRS and send copies to recipients.

Choosing the correct forms is essential for compliance. If a business has elected to be taxed differently (such as an LLC filing as an S corp), different forms will apply.

Step 3: Complete Tax Forms Accurately

After collecting records and identifying the proper forms, the business must complete the paperwork thoroughly and precisely. Accuracy is critical—misreporting income, expenses, or missing deadlines can result in IRS penalties or audits.

Tips for completing forms:

- Follow IRS instructions carefully: Each form includes detailed instructions to guide users through each section.

- Use reliable tax software: Tax filing platforms streamline the process by auto-filling data from connected accounting tools.

- Reconcile accounts before filing: Ensure all bank statements, invoices, and expenses match the income and deductions reported.

- Consult a tax professional: If tax filing becomes too complex, hiring a certified public accountant (CPA) ensures accuracy and uncovers additional tax-saving strategies.

Business owners should retain a copy of all submitted forms and supporting documents for at least three years or longer if assets are depreciated or if the IRS mandates it.

Step 4: Know and Meet Tax Filing Deadlines

Timeliness is critical in tax filing. The IRS and state governments set strict deadlines for both annual and quarterly tax submissions.

Common federal deadlines for 2025:

- January 31: Employers file Form 940 (unemployment tax) and distribute W-2s and 1099s.

- March 15: Partnerships and S corporations file Forms 1065 and 1120-S, respectively.

- April 15: Deadline for sole proprietors and C corporations with calendar-year reporting.

- Quarterly estimated taxes: Typically due April 15, June 15, September 15, and January 15.

Businesses operating on a fiscal year schedule must file taxes by the 15th day of the fourth month after the end of their fiscal year.

Extensions:

- Use Form 7004 to request a 6-month extension for partnerships, corporations, or S corps.

- Sole proprietors can file Form 4868 for an extension on personal returns.

It is important to note that filing an extension provides more time to submit the return but not more time to pay the taxes owed. Payments are still due by the original deadline to avoid penalties and interest.

Step 5: File the Tax Return

With forms completed and deadlines marked, the business can now submit its return. There are two primary ways to file taxes:

E-filing (Electronic Filing):

The most recommended method, e-filing, is faster, more secure, and less prone to errors. Businesses receive immediate confirmation of receipt, and refunds (if any) are processed more quickly.

Mailing a Paper Return:

While still accepted by the IRS, paper filing is slower and involves higher risks of delays or misplacement. If choosing this method, businesses should use certified mail with a return receipt for tracking and confirmation.

After submission, the IRS may follow up with additional notices, especially if payments are due or adjustments are made. Keeping a copy of the return and all supporting documents is essential for responding to any future inquiries.

Conclusion

Understanding how to file small business taxes empowers entrepreneurs to stay compliant, minimize liability, and maintain financial health. From gathering accurate records to choosing the right forms, meeting deadlines, and maximizing deductions, every step contributes to a smoother filing process. By staying organized and possibly seeking help from professionals, small business owners can turn a stressful season into a routine part of business management.